STOCK TALK: Buy Lucara Diamond (In The Rough). Happy Poaching!

I’ll be honest, the first thing that came to mind when writing this headline was the Stone Temple Pilots, ‘Tumble In The Rough’. And upon listening to the tune again, it’s quite fitting as a stock market anthem. A tonne of noise with lyrics about being paralyzed. This is the stock market. If you’re lucky (or trained) you can cut through the noise and maybe get to sing along to the jammy, funky chorus as your stock goes up, maybe. As a side note, someone I’ve always turned to in order to cut through the market noise is the blog & chat of setyourstop.ca The Journal of A Canadian Day Trader. He was referred to me by Frances Horodelski, former BNN personality and comes highly recommended. Learning and perspectives are always a good thing and they should come from a credible source. So you’re welcome.

Anyways, onto what I’m considering as a diamond in the rough, Lucara Diamond, $LUC.TO.

I was recently at a Diamond Symposium in Toronto where all the big wigs of the diamond/mining sector get together to chew the cud. Many of the meetings and discussion by CEO types are dry and barely requires a pulse. But some of it, if you’re paying attention, gets my tail perked and fluffy.

Insert Lucara Diamond. I’ll skip the history and past financials on this one because that’s not the story for me on Lucara. The story for me is CEO, Miss Eira Thomas. Eira is the daughter of Grenville Thomas, who happens to be in the Canadian Mining Hall of Fame. I’ll attach a great little info article at the end for insight. Anyways, Eira is now running, and in charge of Lucara. When she spoke, all the old mining boys in the room listened. She had their undivided attention. ESPECIALLY when she said Lucara (through their new software platform named ‘Clara’) was about to embark on revolutizing how diamonds are bought and sold, all the way from miner, right down to manufacturing and retail. She really RAISED EYEBROWS when she said that Lucara expects to see similar revenues from this new sofware, blockchain, sales venture as they do from their actual shovels in the ground mining ventures. This is YUGE.

It was at that exact moment in which I wrote $LUC.TO in my little black book and was excited to come home and do some further research.

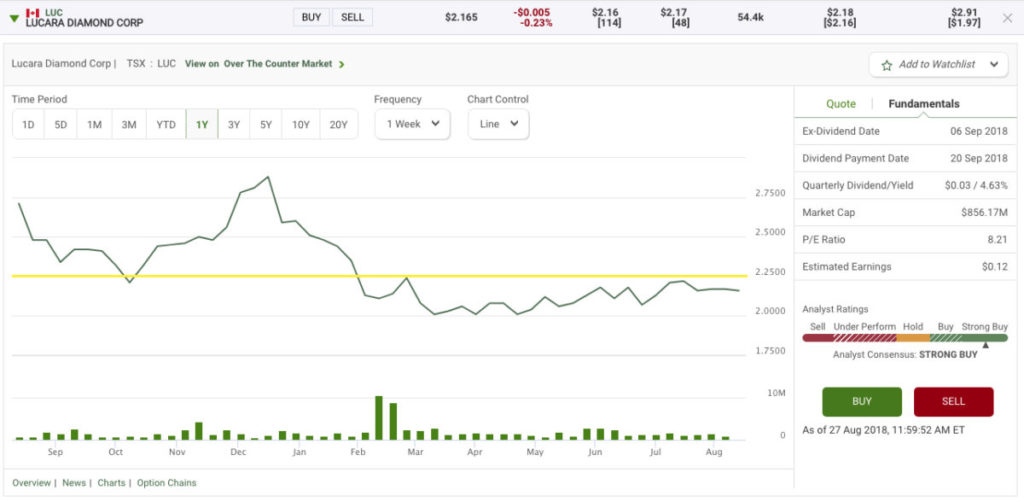

I called setyourstop.ca and he confirmed he knew Lucara, well. He’s known them for years and remembers all their ups and downs. We bounced stories and filled each other in on past operations and future strategies. By the end of the conversation, I was almost ready to take a position and purchase shares. One of the kickers for me was that I wasn’t paying a premium. They were actually off their 3yr high’s of $4.17. I ended up buying at $2.18 and am convinced that the market has not yet priced in their new software sales platform. Once Lucara starts to realize some trickle revenue from Clara, Lucara will be seen as a 50% software sales play. Pretty revolutionary from the mining sector and Lucara just might be the first one to pivot and evolve like this. And I like it.

The final kicker is that they pay a 4.60% dividend just to hold the stock. That’s a very respectable payout that’s inline with what the big banks pay. Maybe even more.

So, I purchased Lucara for my daughters education fund (for the time being) because well, most girls like diamonds and it’s something that pays me while I wait. It’s also not trading at a premium, and has a pure growth story ahead of it.

In the short term, it’s my humble opinion that when, if, $LUC.TO firmly breaks $2.25 (ish) then we have a possible very quick upside to $2.75. That’s quick 20% return plus your 4.60% dividend payment. Not, fucking, bad.

As always, this is not investment advice, do you’re own damn homework and good luck to all.

Happy poaching.

First chart is the 1yr. To me, it shows that if Lucara can trade over the yellow line @ $2.25 (ish) then we have nice run to $2.75 in the near – mid term.

Below the 1yr, is the 3yr. Here it shows that I’m not overpaying for Lucara (around $2.20) and that it’s actually used the last 8 months to brake a two year downtrend.

Hopefully, all of these things combined will make my daughters education fund very happy.

Here’s a little info article on Eira & dad, Grenville Thomas.